(Image via Getty)

Partners are invaluable contributors to law firms. Their experience and business generation are the pillars that support the behemoth of Biglaw, but concerns about mandatory retirement center around two key questions: How do we safeguard ourselves against the inevitable decline of acuity, and how do we ensure that junior partners don’t pile up on the ladder to business succession if partners postpone retirement?

For the former, a plethora of research has shown that cognitive decline is slowed by mental stimulation, which law provides in spades. Pegging the retirement age to a national standard assumes uniform decline which may not be the case. That being said, the higher incidences of alcohol abuse and inadequate sleep among attorneys likely diminishes some of these gains.

For the latter, later retirements mean a logjam at the top of the business succession chain. Though the baby boomer generation opened up the ranks for a lot more partner positions, Biglaw could face a lost generation of partners who are being crowded out of clients by the late-retiring baby boomers.

Firms risk potentially alienating their junior attorneys by catering to the tried and proven. The long-term impact of such policies could be disastrous, which is why many firms are turning to succession plans to keep all parties happy.

Roughly half of Am Law 200 firms have some mandatory retirement policy. Not all stipulate retirement at 65 — most range roughly from 63-68, with different protocols as to how to deal with retiring attorneys. Some firms will transition partners into counsel positions where they can practice while transferring their clients and work to younger partners with longer runways, and others broach the topic of the impending retirement a year or two in advance to ease the partner’s transition out of the law firm.

Not all policies are made equal. Some firms advertise a mandatory retirement age but are willing to skirt it for rainmakers or make other “special exceptions.” That being said, many firms openly embrace lateral partners beyond the mandatory retirement age.

The drop-off in practicing attorneys from age 65 to age 70 is precipitous, especially compared to the U.S. overall population. One slightly confounding variable is the fact that 91.4 percent of partners over the age of 65 are male, who represent a lower percentage of the 65+ population.

Nonetheless, more and more workers are expecting to retire later, and the problem could only worsen with subsequent generations.

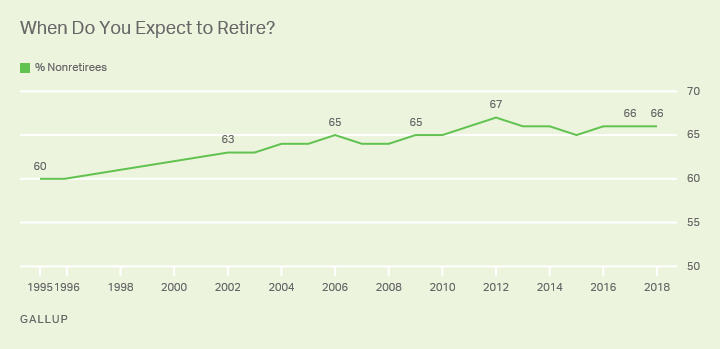

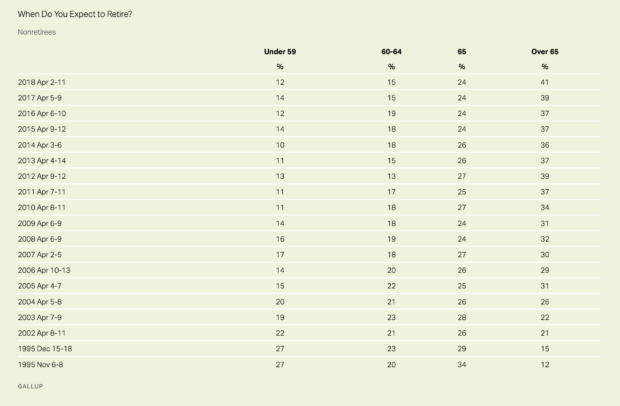

Over the last 20 years, the expected retirement age has risen by six years for non-retirees. Looking at the breakdown, by expected retirement age, the difference becomes even more stark.

From 1995 to 2018, the percentage of workers expecting to retire past the age of 65 has increased almost four-fold. Even in lucrative careers like law, partners are pushing back against hard and soft mandatory retirement policies, putting firms in an uncomfortable position.

Major Am Law 200 firms vary in their commitment to enforce mandatory retirement ages. Some firms take a strict approach to mandatory retirement, like Bradley Arant and Knobbe Martens, who have almost no attorneys over 65 years of age. On the other hand, Holland & Knight, Greenberg Traurig, Duane Morris, and K&L Gates tend to eschew the mandatory retirement requirement.

Promoting partners and associates to create a path to leadership positions, or rewarding them with lucrative client relationships, are efficient ways to seamlessly transfer responsibility to younger lawyers. At the same time, moving client relationships to younger partners also puts the firm at risk. Unless the firm feels the partner is loyal, or at least loyal enough, the firm may not want to transition the relationships too early in a partner’s career.

While the distribution of aging lawyers is trending upwards, firms may have to rethink their insistence on mandatory retirement and succession planning. Relying on a firm mandatory retirement deadline hurts both the lawyer and the firm, especially if there is no succession plan in place. Firms are wiser to ease the severity of the rule and instead impose a soft transition period on a case-by-case basis during which the lawyer could operate in a mentoring capacity to facilitate a smoother transfer of responsibility and relationships.

Moreover, firms have adopted leaner staffing models since the 2009 collapse. After average leverage dropped by 25 percent in one year, it has been slow to rise. Our forecast models estimate that leverage will slightly decrease. This mediates some concerns as there are fewer associates caught in the logjam to partner, but ultimately firms would be better served creating succession plans that allowed for seamless transition of business matters so that they do not lose capable partners.

Executing a proper plan easily solves the dilemmas brought about by mandatory retirement. While identifying an aging leadership problem is helpful, creating and executing an actual plan is a necessity. If your firm needs to benchmark their leadership, or wishes to learn practices to cope with mandatory retirement, I or my colleagues at Lateral Link are happy to share our suggestions and help you craft a game plan based on their real experience with and knowledge of the Am Law 200 law firm market.

Ed. note: This is the latest installment in a series of posts from Lateral Link’s team of expert contributors. Michael Allen is the CEO of Lateral Link. He is based in the Los Angeles office and focuses exclusively on Partner and General Counsel placements for top firms and companies. Prior to founding Lateral Link in 2006, he worked as an attorney at both Gibson, Dunn & Crutcher LLP and Irell & Manella LLP. Michael graduated summa cum laude from the University of California, San Diego before earning his JD, cum laude, from Harvard Law School.

Lateral Link is one of the top-rated international legal recruiting firms. With over 14 offices world-wide, Lateral Link specializes in placing attorneys at the most prestigious law firms and companies in the world. Managed by former practicing attorneys from top law schools, Lateral Link has a tradition of hiring lawyers to execute the lateral leaps of practicing attorneys. Click here to find out more about us.

Lateral Link is one of the top-rated international legal recruiting firms. With over 14 offices world-wide, Lateral Link specializes in placing attorneys at the most prestigious law firms and companies in the world. Managed by former practicing attorneys from top law schools, Lateral Link has a tradition of hiring lawyers to execute the lateral leaps of practicing attorneys. Click here to find out more about us.