Mandy Chimuti looks at the menu board of the small cafe she manages in northern Harare and takes out a black marker. One by one she crosses items out. Coffee: no. Orange juice: no. Cheeseburger: no. Toasted sandwich: no. In the end only salad and homemade lemonade remain.

“No power,” she explains. “Welcome to Zimbabwe. No power, no water, no cash.”

Round the back is a small generator but the queue for diesel is five hours and she doesn’t have the US dollars required. She might have been able to do sandwiches but the country has run out of wheat. So scarce is bread that 500 loaves were stolen in an armed heist last week from a delivery truck in Harare.

Round the back is a small generator but the queue for diesel is five hours and she doesn’t have the

US dollars required. She might have been able to do sandwiches but the country has run out of

wheat. So scarce is bread that 500 loaves were stolen in an armed heist last week from a delivery

truck in Harare.

“We have gone back to olden days,” laughs Chimuti, 43, a single mother with four children.

“I used to have water from a tap; now I have to go to a well with a bucket. I used to switch on the

lights; now I light candles for my kids to do their homework. I used to turn on the heater [it is winter

in Zimbabwe and temperatures drop close to zero at night]; now I use a charcoal burner. I used to

cook on an oven; now I use firewood. We used to have toast for breakfast; now, if we have anything,

it’s a sweet potato.”

Astonishingly, Chimuti is talking about life for an educated working woman in a modern capital,

where you arrive at an airport that has a $150m Chinese-funded extension under construction even

though the national carrier now has only two functioning planes.

Yet when Robert Mugabe was ousted in November 2017 by his generals after 37 years of autocratic

rule, Chimuti celebrated alongside much of the country’s 17m population. “After all we’d been

through, never did I imagine it could be worse,” she said.

But last month inflation hit 98% and prices spiralled so much that a basic margherita pizza in St

Elmo’s cafe was priced at $180 on Friday, while a bottle of cooking oil was on special offer at $26 in

Spar.

For many the last straw came on Monday when the government announced on WhatsApp that it

was scrapping its multicurrency system, banning the use of US dollars and returning to the Zim

dollar, which was ditched in 2008 after inflation soared to 79bn per cent.

The move, officially aimed at ending speculation, came with absolutely no warning, leaving everyone

from businesses to embassies floundering as overnight they found themselves locked out of their US

dollar accounts. Shops and restaurants were forced to set prices in a currency that had yet to exist.

“In 2008 the shops were empty but we had money,” said Chimuti. “Now the shops are full and we

have nothing. This is the worst it has ever been.”

The Zanu-PF MP Justice Mayor Wadyajena with his ‘simply enthralling’ new Lamborghini

She says she should not have been surprised given that the “new dispensation”, as the country’s

rulers term themselves, are the same people who brought Zimbabwe to its knees.

For decades President Emmerson Mnangagwa had been Mugabe’s henchman, involved in some of

his worst atrocities, from the massacre in the 1980s in Matabeleland, in which at least 10,000 died,

to the violent rigging of elections.

However, on taking office he donned a cheerful rainbow knitted scarf, hired an Oxford professor as

finance minister, flew to Davos and declared Zimbabwe “open for business”. He convinced some,

such as the then British ambassador Catriona Laing, that he was a reformed character intent on

rebuilding his country.

Instead, within days of contentious elections last August, the military shot dead six people in the

central business district of Harare in broad daylight. Following protests over the tripling of fuel

prices, a brutal crackdown in January saw at least a dozen people killed and thousands rounded up

and beaten, including teenage girls dragged from their beds.

Primary school teacher Portia Kaya’s salary has shrunk to £1 a day – GRAEME WILLIAMS

With the regime unable to pay the US$87m owed for electricity to South Africa and Mozambique,

power cuts over the past two months have affected residents for 18 hours a day. Electricity comes

on only between 10pm and 4am. At Dandaro Retirement Village, this prompts bizarre scenes in

which elderly residents get up in the middle of the night to do their washing, mow their lawns, and

wash and dry their hair.

The bread shortage is the result of a failure to pay Belarus to release wheat imports from bonded

warehouses, Zimbabwe’s own production having plummeted.

“We used to have a political and economic crisis,” said Peter Mutasa, president of the Zimbabwe

Congress of Trade Unions (ZCTU). “Now we have a humanitarian crisis. The system has created a

whole sea of people living in abject poverty. Workers are literally starving in their houses.”

Yet some people profit from chaos and those with contacts in the ruling elite are doing extremely

well, selling on the black market. MPs do not pay import duty on cars and there is a Jaguar

showroom just down the road from the headquarters of the ruling Zanu-PF party.

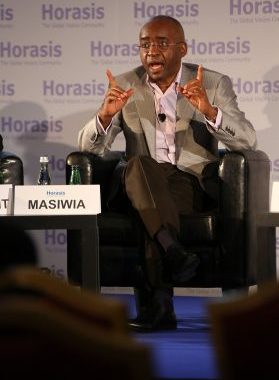

Earlier this month Justice Mayor Wadyajena, a Zanu-PF MP and an associate of Mnangagwa, posted

a picture on Twitter of his new yellow Lamborghini. “I’m one hell of a satisfied customer,” he wrote.

“This Super SUV is unbelievable; that primordial roar is simply enthralling.” When someone

questioned how he got the US$210,000 reported by ZimLive to buy the supercar, he replied that it

actually cost double that figure.

This is beyond imagination to Portia Kaya, 42, a primary school teacher, whose salary has shrunk to

£1 a day. She invites me to her home in Glenwood, where she is cooking dinner of a pan of sadza

(cornmeal porridge) on a small fire outside her house. As dusk falls neighbours emerge with bundles

of firewood and hundreds of tiny fires are lit while others queue with buckets at the well for water.

Inside Kaya’s house are an oven, fridge-freezer and television. “We just sit and look at them,” she

laughs as she lights a candle to start her marking.

Cafe manager Mandy Chimuti: ‘This is the worst it has ever been’ – GRAEME WILLIAMS

In the past, after a day teaching a class of 60 six and seven-year-olds, she used to cook for her sister

and baby niece, with whom she shares two rooms. Then she would either study for her master’s or

put her feet up and watch TV. “It wasn’t much of a life but it was a life,” she says. “Now it’s just a

struggle.”

Her monthly salary is RTGS$600 (real-time gross settlement) — a virtual currency, transferred by

phone, an ingenious way for the government to avoid printing money. It was supposed to be worth

2½ to the dollar when introduced in February. However by last week the rate had fallen to 14,

equivalent to £1 a day.

From this she pays RTGS$160 for transport to school, RTGS$120 for rent in a house shared with

three other families and RTGS$100 that she sends to her ageing mother. Every day she pays

RTGS$2½ for a candle and between three and four for firewood. Sugar, washing powder and cooking

oil cost her RTGS$120.

In addition the government imposes a 2% levy on every transaction. She often has to borrow at

exorbitant rates to tide her over to the next month. Most days she leaves for work with no food,

leaving her exhausted while her pupils often faint from hunger.

“Some of my fellow teachers have had to pull their children from school because they can’t afford

the fees,” she said. Others supplement their income by working as prostitutes.

Those with contacts in the ruling Zanu-PF elite are doing extremely well – GRAEME WILLIAMS

“People are dying in their homes because they can’t afford medical care,” said Mutasa, the ZCTU

president. “And these are working men and women. Imagine those who are not.” Only 5.4% of the

workforce hold formal jobs. The rest eke out an existence at the roadside selling a few tomatoes,

sticks for firewood or sitting in the endless fuel queues.

It was apparently a fear of demonstrations and unrest in the barracks among soldiers, whose salaries

have also shrunk in value, that prompted an emergency meeting last weekend between the

president, the finance minister and the state bank governor. After making Monday’s currency

decision, of which even the International Monetary Fund wasn’t told, the last two immediately flew

to China to seek funding. Many believe the move could backfire.

“This is the biggest gamble since the coup,” said Tendai Murisa, who runs Citizens Watch, which

monitors the government.

Both business and unions condemned the move. The ZCTU is raising funds to challenge the move in

court and consulting members about protests such as a stayaway.

But its president knows only too well the dangers he faces. Over the past 18 months Mutasa has

been arrested three times and jailed twice. On Friday evening, after we met, he had to report to the

police because he is on bail accused of subversion of the constitution and inciting public violence,

which carries a sentence of 20 years.

“They are using all instruments of oppression to instil fear in people and specifically targeting

leaders,” he said. “Mugabe would beat and maim you but this new government is shooting people in

the streets.”

Despite the desperate economic situation, the government recently purchased a new arsenal,

including 3,343 AK-47 assault rifles, 600 sniper rifles and 58,500 grenades, posting pictures of them

on Facebook.

“Those ruling us only care about protecting their wealth,” said Mutasa, the trade union leader.

“Violence is the only language they understand. I think we need to fight back to create a base for our

kids even if we die in the process.”

Back at the cafe with only two items on sale, though, Mandy Chimuti is worried. “I guess in most

countries people would rise up, but here we fear what the regime would do,” she said.

“They’ve brought us down to zero — they know that. And if we die for no change, what will happen

to our children then?”